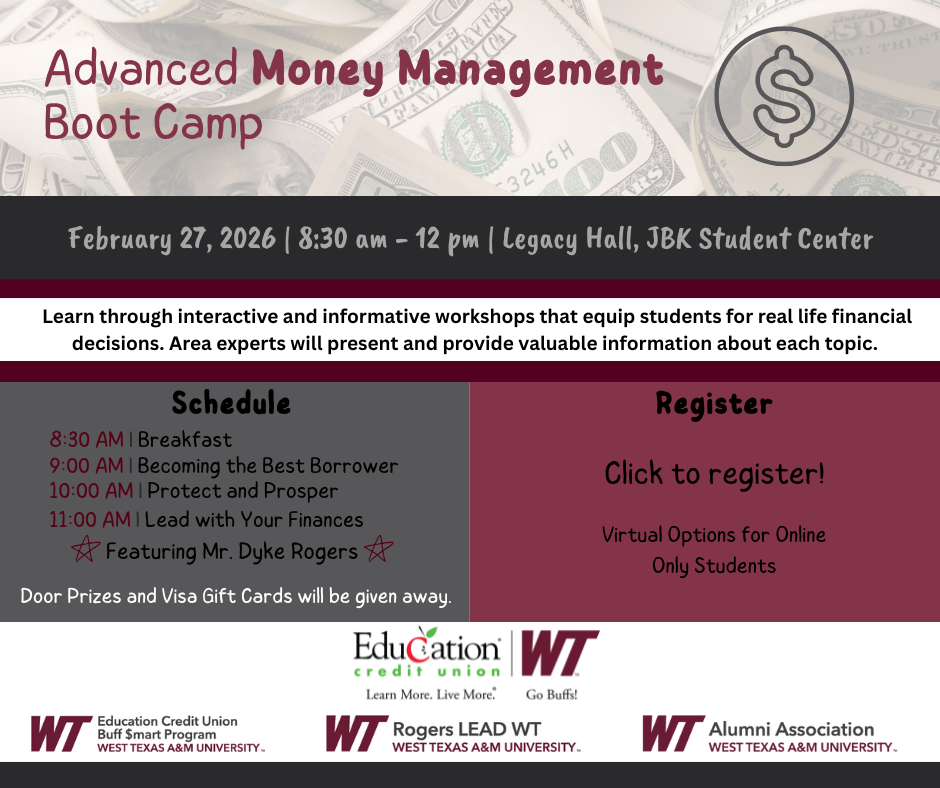

2026 Advanced Money Management Boot Camp

ECU Buff $mart, WTAMU Alumni Association and Education Credit Union are proud to host our 8th annual Advanced Money Management Bootcamp. Join us on February 27, 2026 in Legacy Hall at 8:30 am. Breakfast will be served and door prizes and gift cards will be given away.